Based on recently leaked exchange house databases (Amin, Pedram Pirouzan, Sadaf and Radin), WikIran has identified over 30 global banks that have provided financial services to Iranian front companies linked to these exchanges, unknowingly enabling international sanctions evasion and facilitating money laundering.

In our previous investigations, we exposed the main "enabler" banks supporting the shadow banking ecosystem in connection with Sepehr Energy Jahan. This article, compiled from four separate leaks, reveals more than 600 bank accounts, held in Chinese, UAE or Turkish banks. This article does not only expose the bank accounts or the host banks, but also identifies the correspondent banks involved in EUR and USD transactions, and the legal and regulatory risks these institutions now face.

A table detailing all bank accounts, including the host banks, currencies and links to the respective exchange houses, is available for download at the end of the article.

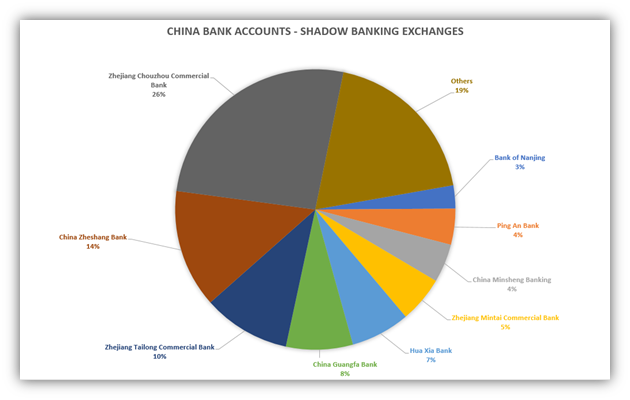

Chinese banks

The majority of the bank accounts (347 in total) are hosted in Chinese Banks in China or Hong Kong. The most prominent host banks are: Zhejiang Chouzhou Commercial Bank (26%), China Zheshang Bank (14%) and Zhejiang Tailong Commercial Bank (10%).

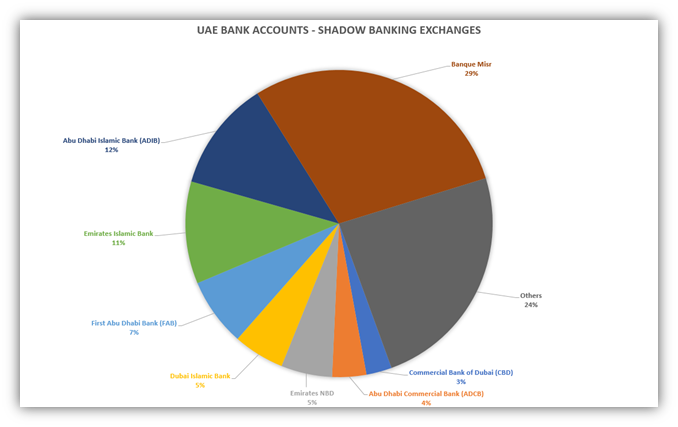

UAE Banks

Despite widespread use of UAE banks by Iranian Shadow Banking entities, Banque Misr stands out as a significant host of accounts (29%), followed by Abu Dhabi Islamic Bank (12%) and Emirates Islamic Bank (11%).

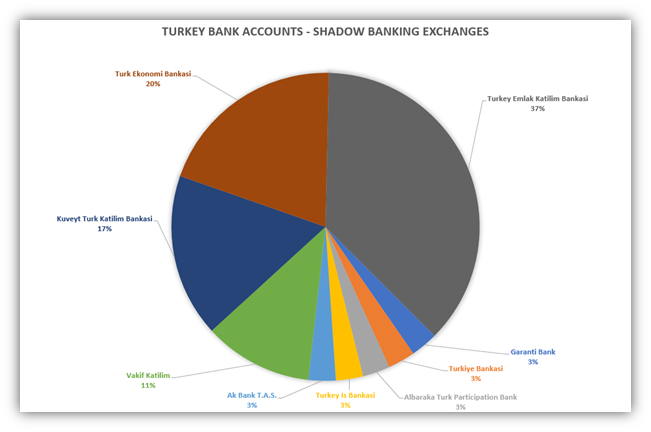

Turkish banks

In Turkey, most of the shadow banking accounts are hosted in the Turkey Emlak Katilim Bankasi (37%), Turk Ekonomi Bankasi (20%), Kuveyt Turk Katilim Bankasi (17%) and the wll-known to WikIran, Vakif Katilim (11%).

Correspondent banks: The Hidden Link in the Chain

Correspondent banks are the financial institutions that provide banking services to other banks, often in a different country or region. They act as intermediaries between banks, facilitating international transactions, settlements and clearing of payments.

For example, when a front company of an Iranian exchange house conducts a transaction denominated in EUR from its account in Banque Misr in the UAE, the transaction must pass through one of Banque Misr's correspondents in Europe, such as Commerzbank or Standard Chartered; The same concept applies to American JP Morgan or Bank of America, that serve as key correspondents in USD-denominated transactions.

The table below lists of the main host banks exposed in the article and their EUR and USD correspondent banks:

| Bank | Country | Correspondents - EUR | Correspondents - USD |

|---|---|---|---|

| China Zheshang Bank | China/Hong-Kong | Deutsche bank, Commerzbank, Standard Chartered (GER) | Bank of America, Citibank, JP Morgan |

| Zhejiang Chouzhou Commercial Bank | China/Hong Kong | Barclays, Commerzbank | Bank of America |

| Ping An Bank | China/Hong-Kong | Commerzbank, Industrial & Commercial Bank of China Limited (Germany) | Bank of America National Association, Citibank NA, Standard Chartered Bank, The Bank of New York Mellon, Wells Fargo Bank National Association, Citibank NA, Standard Chartered Bank, Standard Chartered Bank (Hong Kong) Limited, The Bank of New York Mellon |

| Hua Xia Bank | China/Hong-Kong | Bank of China Limited (Germany), Bank of Communications Co Ltd (Germany), Commerzbank, Deutsche Bank, Standard Chartered Bank (Germany) | Bank of China Limited (USA), Citibank NA, Deutsche Bank Trust Company Americas, HSBC Bank USA National Association, JP Morgan Chase Bank National Association, Bank of China (Hong Kong) Limited, Bank of China Limited (USA), Citibank NA, Deutsche Bank Trust Company Americas, HSBC Bank USA National Association, JP Morgan Chase Bank National Association |

| Bank of Nanjing | China/Hong-Kong | BNP Paribas SA (France), Commerzbank (Germany) | Citibank NA, JP Morgan Chase Bank National Association, The Bank of New York Mellon, Wells Fargo Bank National Association |

| Banque Misr | UAE | Commerzbank, Standard Chartered | Citibank, HSBC, JP Morgan, Standard Chartered, NY Mellon |

| First Abu Dhabi Bank | UAE | Deutsche Bank, ING Belgium SA/NV, Societe Generale S.A. (France), UniCredit Bank GmbH (Germany | Citibank NA, JP Morgan Chase Bank National Association, Wells Fargo Bank National Association |

| Dubai Islamic Bank (DIB) | UAE | Deutsche Bank | Bank of America National Association, Citibank NA, Deutsche Bank Trust Company Americas, JP Morgan Chase Bank National Association, Standard Chartered Bank, The Bank of New York Mellon |

| Emirates NBD | UAE | Citibank Europe Plc (Ireland), HSBC Continental Europe S.A. (France), ING Belgium SA/NV | Bank of America National Association, Citibank NA, JP Morgan Chase Bank National Association, Standard Chartered Bank, The Bank of New York Mellon, Bank of America National Association, Citibank NA, JP Morgan Chase National Association, Standard Chartered Bank, The Bank of New York Mellon |

| Emirates Islamic Bank | UAE | Barclays Bank Ireland plc (Germany), Societe Generale S.A. (France) | Citibank NA, Standard Chartered Bank, Citibank NA, HSBC Bank USA National Association, Standard Chartered Bank, The Bank of New York Mellon |

| Abu Dhabi Commercial Bank (ADCB) | UAE | ABN AMRO Bank NV (Netherlands), Bank of America National Association (UK), CaixaBank SA (Spain), UniCredit SpA (Italy) | Bank of America National Association, Citibank NA, Deutsche Bank Trust Company Americas, JP Morgan Chase Bank National Association, Standard Chartered Bank, The Bank of New York Mellon, Wells Fargo Bank National Association, Bank of America National Association, Citibank NA, Wells Fargo Bank National Association |

| Vakif Katilim | Turkey | Commerzbank, HSBC Continental Europe S.A. (France), J.P. Morgan SE (Germany), KT Bank AG (Germany), Standard Chartered Bank AG (Germany), The Bank of New York Mellon (Germany), Unicredit Bank GmbH (Germany) | Citibank, The Bank of New York Mellon |

| Kuveyt T�rk Kat?l?m Bankas? | Turkey | Deutsche Bank AG, Intesa Sanpaolo SpA (Italy), ICT Bank AG (Germany), Raiffeisen Bank International AG (Germany), Societe Generale S.A. (France), Standard Chartered AG (Germany), UniCredit SpA (Italy) | Citibank NA, HSBC Bank USA National Association, Standard Chartered Bank, The Bank of New York Melon, HSBC Bank USA National Association, Raiffeisen Bank International AG (Austria), Standard Chartered Bank, The Bank of New York Mellon |

| Turkiye Emlak Katilim Bankasi | Turkey | Banco de Sabadell SA (Spain), Barclays Bank Ireland plc (Germany), Intesa Sanpaolo SpA (Italy), ICT Bank AG (Germany), Raiffeisen Bank International AG (Austria) | MashreqBank PSC (USA), Raiffeisen Bank International AG (Austria), The Bank of New York Mellon |

Legal and Regulatory Risks

When a correspondent bank provides services to a host bank that knowingly or unknowingly hosts accounts for sanctioned entities, it becomes complicit in sanctions evasion. This exposes the bank to severe legal and financial consequences, including:

-

OFAC penalties: In the United States, the correspondent bank may face penalties for violations of the Office of Foreign Assets Control (OFAC) regulations, prohibiting transactions with sanctioned entities.

-

Anti-Money Laundering (AML) and Combating the Financing of Terrorism (CFT) regulatory breaches: By failing to conduct proper due-diligence and providing services to a bank that hosts sanctioned entities, the correspondent bank may breach AML/CFT regulations. These frameworks require financial institutions to identify and report suspicious transactions.

-

Regulatory fines and penalties: The correspondent bank may face fines and penalties from regulators in their home jurisdiction and/or other jurisdictions where they operate.

The banks hosting these accounts have failed in their core compliance responsibilities to conduct thorough due diligence, implement sanctions screening and monitor and report suspicious transactions.

Meanwhile, the correspondent banks, have also fallen short in fulfilling their duty to know their respondent bank: Their business models, reputations and compliance framework. They have also failed to assess the risks and to monitor the transactions.

A Call for Action

The international financial community must take notice of the banks exposed above. By providing services to entities associated with Iranian money exchanges, these banks are not only facilitating sanctions evasion and money laundering, but are also undermining global efforts to combat illicit financial activities.

It is imperative that these institutions reassess their client base, strengthen due- diligence process, and comply with international sanctions and anti-money laundering regulations to avoid severe consequences, including legal action and reputational damage.

WikIran's exposure of these banking activities is a stark reminder of the ongoing battle against Iranian financial crimes and the critical role of financial institutions in preventing the misuse of the global financial system.