For the first time, WikIran exposes an Iranian exchange house that is directly owned by one of the country's leading banks, with the Iranian state as a shareholder. Unlike privately-owned exchange houses, Tejarat Exchange is a wholly-owned subsidiary of Tejarat Bank.

Tejarat Bank was initially sanctioned by the United States and the European Union in 2012 for providing financial services to Iranian entities that were subject to sanctions due to their involvement in the Iranian WMD manufacturing program, including the Iranian Revolutionary Guard Corps (IRGC), National Shipping Company IRISL and Melat Bank. Additionally, Tejarat Bank played an active role in the Iranian nuclear weapons development program, facilitating a transfer of tens of millions of US dollars in 2011 to assist the Atomic Energy Organization of Iran (AEOI) in procuring uranium.

Tejarat Bank was most recently sanctioned in November 2018 for providing financial and technological assistance, as well as goods and services, to sanctioned entities Sepah Bank and Mahan Air. Furthermore, the Bank provided services and assistance to various subsidiaries and entities related to the IRGC and MODAFL.

Bank Tejarat is one of the three major shareholders of EIH Bank, also known as the Iranian-European Bank, headquartered in Hamburg, Germany. Tejarat banks holds 20% of its shares and both banks have been linked to different proliferation efforts, indicating a degree of similarity in their operations.

Tejarat Exchange, the money exchange house directly affiliated with the bank of the same name, was founded in 2009, according to the Iranian companies' registry (or in 2013, according to their own website). The exchange house offers various services to its clients, including the procurement of foreign currency for export purposes using the Central Bank's NIMA and SANA systems, foreign currency exchange, money transfers and more.

According to their website, their main clients are exporters and importers of goods, with a focus on countries such as the UAE, Turkey, Iraq and Afghanistan. However, a closer examination of the documents we are revealing for the first time shows that Tejarat Exchange is heavily involved in bypassing of international sanctions by providing its services to front companies used by the Iranian regime to circumvent sanctions, primarily in China and Hong Kong.

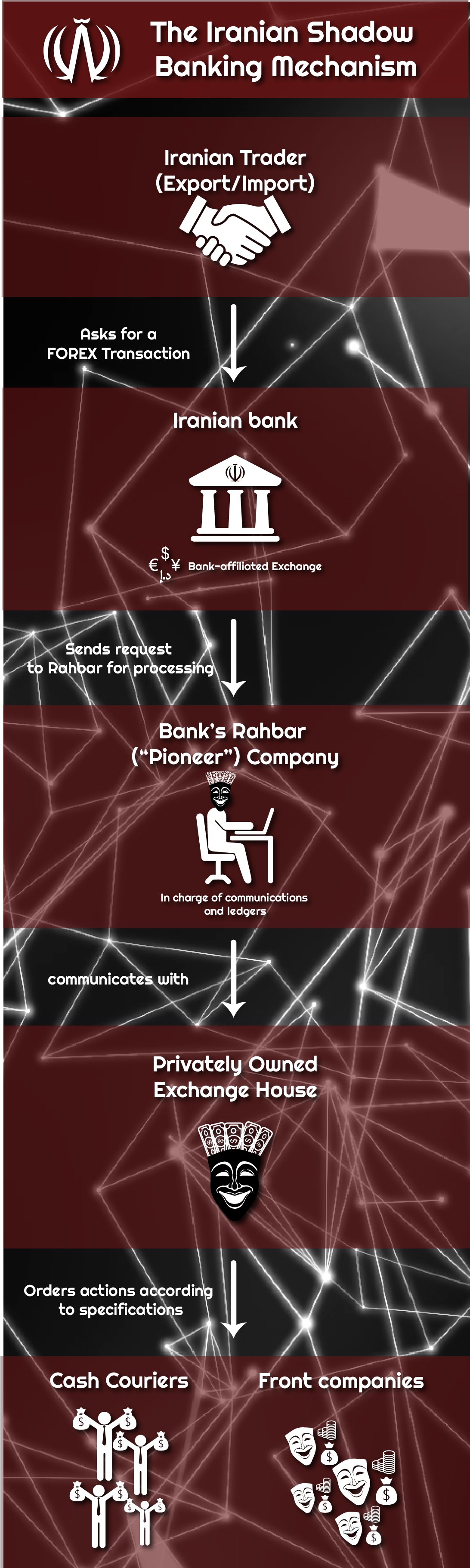

Banks and their exchange subsidiaries, such as Tejarat Bank and Tejarat Exchange, have a crucial role in Iran's Shadow Banking mechanism. Unlike private exchange houses, which have been previously exposed on WikIran, bank-affiliated exchanges facilitate the bank's business with various private exchanges, benefiting both the bank and its customers. Simply put – bank-affiliated exchanges "rent" private exchanges' foreign currency transferring capabilities, mainly using front companies and bullk cash carries ("money mules") on behalf of the bank and its customers. This way, banks can easily access the international financial systems without setting up front infrastructures themselves.

The role of exchange houses affiliated with banks in Iran’s “Shadow Banking” mechanism is widely discussed and significantly tarnishes the Iranian financial system, due to their blatant disregard for anti-money laundering (AML) and terror financing (TF) laws, rules and standards.

Mrs. Behnaz Zolfaghari is the current board chairman of the exchange house. Under her leadership, the exchange experienced a significant decrease of 33% in net worth and 64% in operational revenues, compared to the previous year. Despite exchange house's decline, local Iranian media reports indicate that the exchange house distributed substantial bonuses to its board members, including Zofaghari herself.