Here are all of the articles we published on Zarrin Ghalam:

- Exposing Another Iranian Exchange House ZarrinGhalam Violating Sanctions

- Exposing How ZarrinGhalam Exploits European Correspondent & Settlement Services for Iran's Covered Transactions

- Exploiting Financial Controls Loopholes for Iran's Covered Transactions

- Exposing How Iran Utilizes Front Companies in UAE for Its Covered Transactions

WikiIran's analysis of the recently leaked information from ZarrinGhalam's servers reveals that the ZarrinGhalam Exchange House, one of Iran's largest money exchange houses, constitutes a correspondent for Iran-based clients which are restricted of transferring funds from and to Iran due to the sanctions. The ZarrinGhalam utilizes its international front companies so to carry out these transactions for the Iranian clients.

The following examples exemplify how these transactions have been taking place. The first impression is that the international aspects of the deals are being handled completely independently and detached from the ZarrinGhalam. However, WikiIran has learned through a comprehensive analysis of the database leaked from the ZarrinGhalam that the ZarrinGhalam is in full control of its front companies abroad.

Each deal involves several entities as the following (like Tahayyori's network):

-

The Money Exchanger: Refers to the ZarrinGhalam, specifically to two of its main exchange houses: the GCM Exchange and the Berelian Exchange. These are the Iranian entities which assist with carrying out transactions between the Iranian client (companies or banks) and its international clients and suppliers, through the network of its international front companies.

-

The Iranian Client: The Iranian company or financial institution which needs to transfer funds from or to Iran, but cannot make it due to the sanctions and some financial restrictions. These entities utilize the money exchange house's front companies around the world so to make the payments circumventing the sanctions.

-

The Front Company: The company, seemingly a legitimate one and in full control of the ZarrinGhalam, is based outside Iran (mainly in the UAE and China) for carrying out international transactions for Iranian clients and banks.

-

The Front Company's Hosting Bank: This is the foreign bank outside Iran where the front company holds its bank account with foreign currency. This account enables the front company to provide foreign currency to the Iranian clients upon their requests.

-

The Recipient: The legitimate company or an illegitimate one (such as another front company) which is based outside Iran and maintains business relationship with the front company

-

The Beneficiary Bank: This is the bank where the beneficiary side of the deal maintains its bank account. Although most of the bank accounts of the front companies are in the UAE and China, there are some accounts also in Europe (as you can see in the leaked documents).

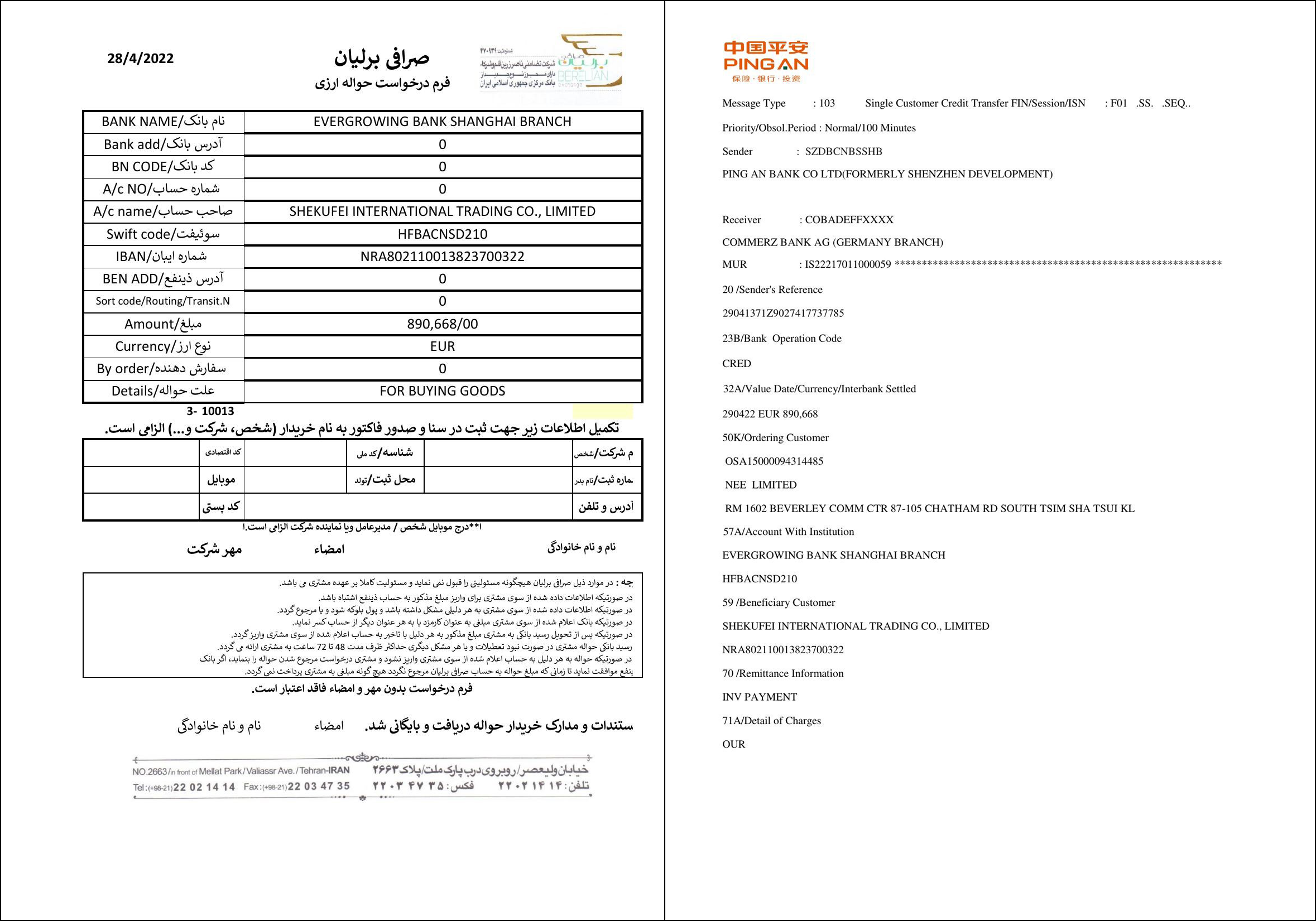

The following two documents prove that the company "Shekufei International Trading Co., Limited" is indeed a front company of the Iranian exchange house Berelian (one of ZarrinGhalam's registered companies). These documents also reveal the method and how the Iranian hidden financial activities are being carried out via a German bank such as Commerzbank AG.

The first document, with the Berelian's letterhead, dated April 28, 2022, includes also bank information of the company "Shekufei International" at the bank "Evergrowing Bank Shanghai Branch", account number: NRA802110013823700322. This is a form sent by the Berelian to an Iranian client requiring the client's information so the Berelian would issue the receipts and register it with the foreign currency management system "Nima System" of the Iranian central bank. At the bottom of the page, the Berelian declares in Persian that the Berelian "waives its liability in carrying out this money transfer".

This document highlights that the Berelian was indeed involved in coordinating deals between the Iranian clients and the Shekufei for the total amount of 890,669 Euro. Therefore, it is most probably likely that the Shekufei is actually the Berelian's front company.

In the second document from right, you can see the transfer of 890,668 Euro on the following day (April 29, 2022). This transaction was conducted by the Chinese bank "Ping An Bank", using the Euro correspondent services of the German bank "Commerzbank AG".

This fund was transferred from a bank account of "Nee Limited" to the bank account of the "The Shekufei International Trading Co, Limited," at the bank "Evergrowing Bank Shanghai Branch", bank account: NRA802110013823700322.

The leaked documents from ZarrinGhalam's servers include tens of thousands of documents with sensitive information such as the deals exposed here by WikiIran which have been carried out by the Iranian exchange house. This information is an additional evidence pointing out that the Shekufei is one of many front companies operated by the ZarrinGhalam.

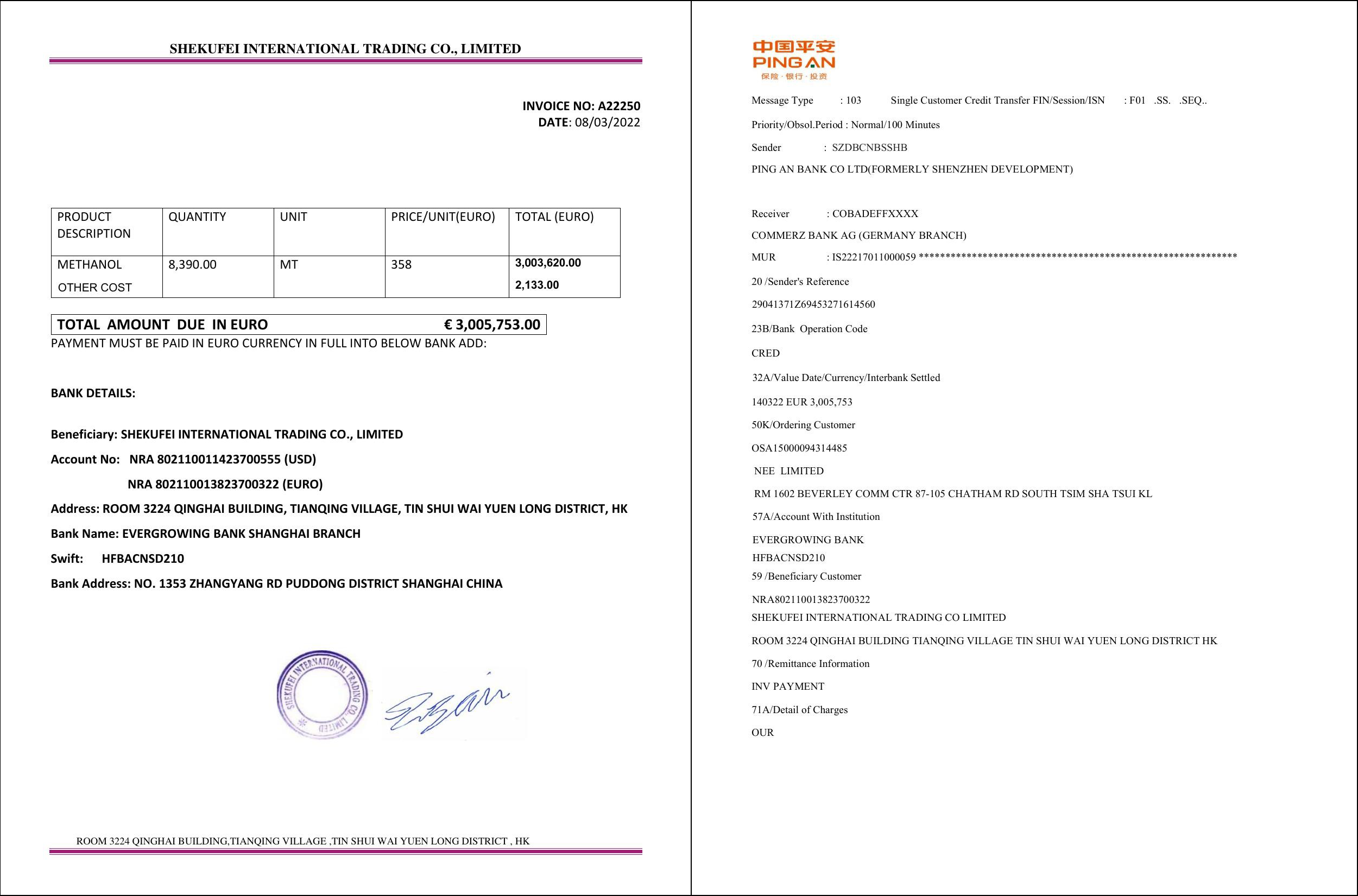

The following documents are about the transfer of 3,005,753 Euro from the bank "Nee Limited" to the Shekufei. The invoice was issued on March 8, 2022, and the transfer was made on March 14, 2022. The amount of transaction is the same in both documents, an indication that these two documents are related.

The above documents, reviewed by WikiIran, and tens of thousands of other documents leaked from ZarrinGhalam's servers, all are evidence of how the Iranian exchange house uses its front companies abroad, such as the Shekufei, so to hide Iranian illegal financial activities around the globe. As noticed, these wide-range activities carry out also implications for the European financial institutions as they go through the foreign current exchanges, such as the German bank "Commerzbank AG."

About "Nima System" Operated by Iranian Central Bank:

The Nima System is Iran's central bank system for managing Iranian foreign currency. The system matches the Iranian importer's demands and the Iranian exporter's supply of foreign currency funds in varying fixed forex rates, and documents each foreign exchange conversion between the exporter and the importer. This system enables the Iranian central bank to improve its control over the Iranian foreign exchange market.